Start Strong: Why Investor Matchmaking UK Changes the Game

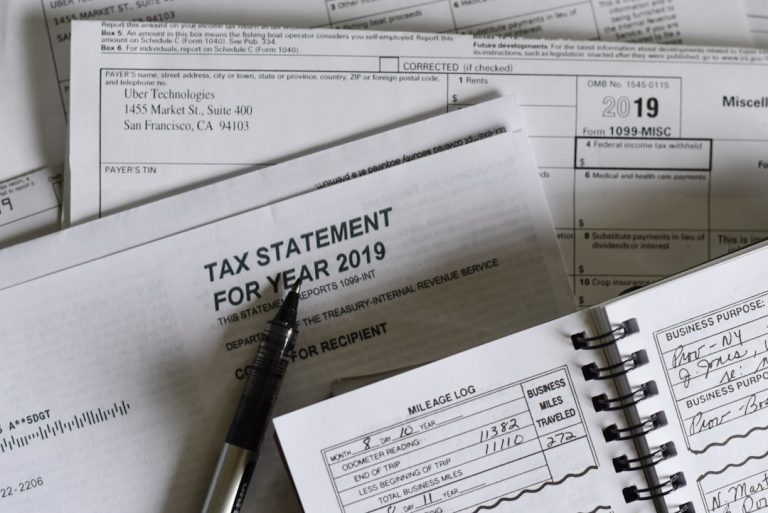

In today’s fast-moving UK startup landscape, finding the right investor isn’t a numbers game. It’s about quality, fit and timing. Investor matchmaking UK can feel daunting. You’re juggling SEIS/EIS rules, tax incentives and a crowded market. But imagine a clear path where you only meet investors who care about your sector, stage and growth plans. That’s the promise of smart matchmaking.

We’ll show you how to build confidence, cut through the noise and connect with investors who share your vision. From defining your ideal backer to leveraging curated digital platforms, these insider tips will transform your fundraising. Ready to see how Investor matchmaking UK: Revolutionising Investment Opportunities in the UK can work for you? Let’s dive in.

Understanding the UK Investor Ecosystem

Before any introductions, get a bird’s-eye view of who’s investing and why.

Why SEIS and EIS Are Your Best Friends

• SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) offer up to 50% income tax relief.

• You need to qualify, but once you do, you open doors to a pool of tax-savvy angels.

• Investors hunt for ventures that tick both their financial and regulatory boxes.

Types of Investors in the UK Scene

- Angel Investors

– Often seasoned entrepreneurs.

– Quick decision-makers. - Venture Capital (VC) Funds

– Look for scale.

– More paperwork, but deeper pockets. - Syndicates and Co-investment Clubs

– Combine expertise with shared due diligence. - Family Offices and High-Net-Worth Individuals

– Long-term mindset, often sector-specific.

Knowing these categories helps you tailor your outreach. Don’t send the same pitch deck to everyone. Precision beats spray-and-pray.

Foundational Steps to Effective Matchmaking

You wouldn’t swipe right on every profile. The same goes for investor outreach.

1. Define Your Perfect Investor Profile

Ask yourself:

– Which sectors appeal most?

– What cheque size suits your runway?

– Do you want hands-on mentorship or a silent partner?

Write it down. A clear profile saves time and positions your pitch effectively.

2. Craft a Standout Pitch Deck

Your deck is your first handshake. Keep it:

– Clear: One big idea per slide.

– Concise: Aim for 10–12 slides.

– Data-driven: Show traction, projections and team credentials.

A robust deck ensures you only pass along opportunities that meet investor expectations.

3. Vet and Curate with a Trusted Platform

Many founders rely on scattershot emails or open crowdfunding. That wastes precious time. Instead, choose a service that pre-screens investors and startups. Oriel IPO’s commission-free model pairs you with backers who understand SEIS/EIS intricacies. A digital marketplace means you can:

– Showcase your opportunity in a central hub.

– Benefit from educational guides on tax relief.

– Keep more capital thanks to transparent subscription fees.

This approach trumps traditional consultancy matchmakers that charge commissions or pitch decks without follow-through.

Advanced Tips for Smarter Introductions

Once your groundwork is solid, it’s time to connect.

4. Leverage Warm Networks

Cold emails yield low response rates. Instead:

– Use LinkedIn intros from mutual connections.

– Join industry groups and online forums.

– Attend sector-specific meetups or webinars.

A referral gives you instant credibility.

5. Personalise Every Outreach

Nothing lands like a bespoke note. Reference:

– The investor’s recent deals.

– A mutual industry contact.

– Specific aspects of their portfolio that excite you.

You’ll stand out from generic pitches.

6. Stick to a Simple Process

Investors hate inbox clutter. Adopt a funnel:

1. Initial email with a teaser.

2. Follow-up with one-pager or deck.

3. Quick call to assess interest.

4. Full video or in-person pitch.

5. Formal diligence phase.

This clarity saves everyone time and boosts your hit rate with investor matchmaking UK.

Making Oriel IPO Work for You

So why pick a subscription-based, commission-free platform over other models? Here’s the lowdown:

• Commission-free funding means you keep more of the investment.

• Curated, vetted opportunities ensure investors trust what they see.

• Educational resources on SEIS/EIS simplify compliance.

Oriel IPO’s streamlined approach has helped dozens of UK startups secure the right matches—and it can do the same for you. Ready to streamline your investor matchmaking UK approach? Let’s get started with a personalised demo. Revolutionising Investment Opportunities in the UK

Common Pitfalls and How to Avoid Them

Even the best plans hit roadblocks. Here’s how to sidestep the usual traps:

Overloading Investors

Don’t flood inboxes with every document you have. One deck at a time. One call to action.

Ignoring Fit

A big cheque from the wrong backer can stall growth. Stick to your investor profile and trust the vetting process.

Skipping Follow-Up

If an investor asks for more info, get it over within 48 hours. Promptness shows professionalism.

By keeping communication tight and focused, you’ll maintain momentum—essential in a competitive UK funding market.

Bringing It All Together

Matchmaking isn’t magic. It’s methodical. Define your profile. Build a crisp deck. Use a trusted platform like Oriel IPO. Personalise each approach. And follow up relentlessly.

You’ll cut down on wasted effort. You’ll secure meetings that matter. And you’ll access capital under SEIS/EIS with ease.

Testimonials

“I was struggling to find UK investors who understood my fintech startup’s nuances. Oriel IPO’s curated onboarding and SEIS guidance made the whole process feel straightforward. We closed our round 30% faster than traditional routes.”

— Sarah Mitchell, Co-Founder, FinTechFlow

“The subscription model was a breath of fresh air. No hidden fees. No surprises. We met three compatible angel investors in weeks, not months.”

— James Patel, CEO, GreenEnergy Innovations

Ready to Transform Your Fundraising?

Don’t settle for generic pitches or high-fee matchmaking. Embrace a platform built for founders and investors alike. Start your investor matchmaking UK journey today

With the right strategy and a partner who knows SEIS/EIS inside out, your startup can reach its next milestone—faster, smarter and commission-free.