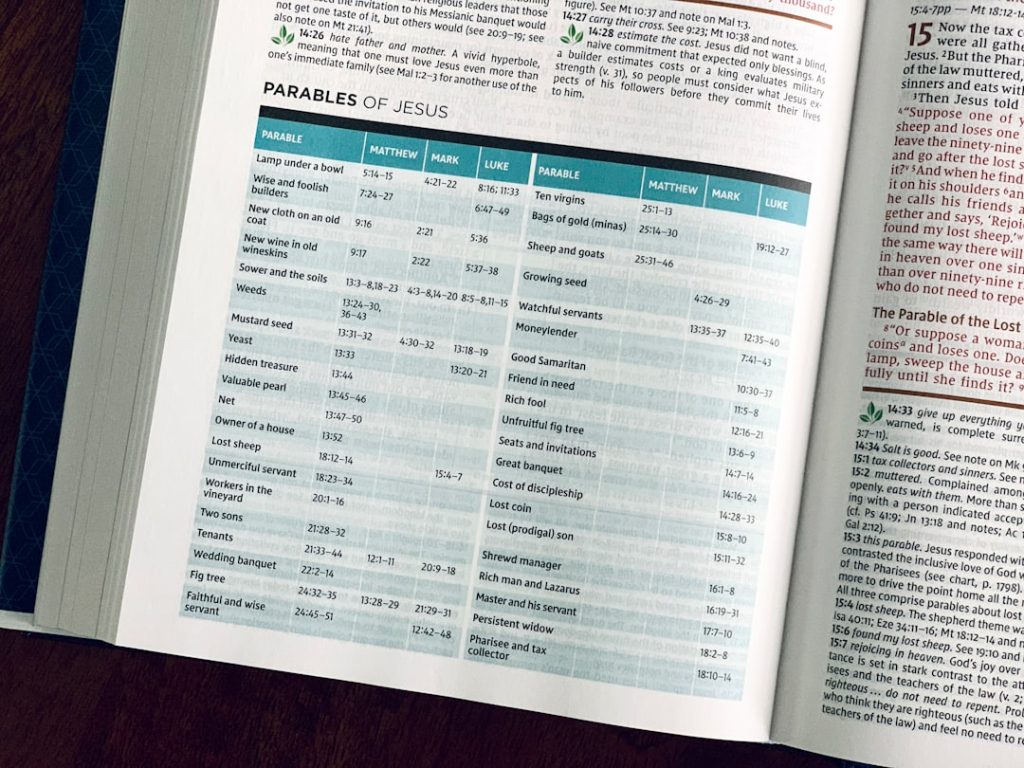

What is SEIS? Understanding Seed Enterprise Investment Scheme on Oriel IPO

Learn how SEIS grants tax relief and discover commission-free funding opportunities on Oriel IPO’s curated startup investment platform.

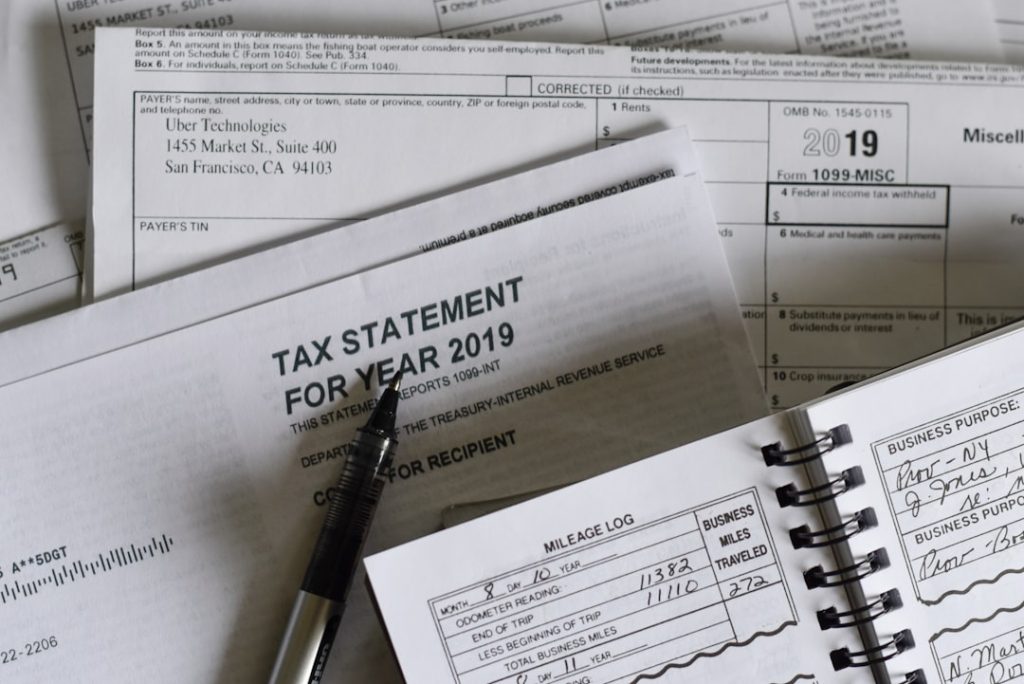

How to Claim SEIS & EIS Tax Relief: Complete Guide for Angel Investors | Oriel IPO

Follow Oriel IPO’s expert steps to maximize your SEIS and EIS tax relief and invest confidently in UK startups with our commission-free marketplace.

Essential SEIS Investment Documents: Download Standardised Templates on Oriel IPO

Access our curated SEIS investment document templates and simplify your early-stage fundraising with Oriel IPO’s commission-free, tax-focused platform.

SEIS & EIS Advance Assurance Made Easy: Commission-Free Compliance Guide by Oriel IPO

Secure HMRC advance assurance for SEIS and EIS funding with Oriel IPO’s easy, commission-free compliance guide designed for startups.

UK SEIS Tax Relief Demystified: Detailed Guide to Maximise Savings with Oriel IPO

Navigate UK SEIS tax reliefs and maximise your savings seamlessly with Oriel IPO’s detailed, commission-free guide to SEIS benefits.

Unlock SEIS & EIS Benefits: Startup Funding Strategies with Oriel IPO

Discover how SEIS and EIS schemes can fuel your startup’s growth and attract investors through Oriel IPO’s commission-free funding platform.

SEIS Eligibility Simplified: Meet Criteria & Apply Commission-Free with Oriel IPO

Check your startup’s SEIS eligibility and apply with confidence using Oriel IPO’s simplified, commission-free guide to SEIS requirements.

Maximise Your SEIS Tax Reliefs: Investor’s Guide to Early-Stage UK Startups

Unlock generous SEIS tax reliefs and grow your investments in UK startups with Oriel IPO’s expert guide tailored for private investors.

Streamlined UK Startup Funding with SEIS & EIS: Oriel IPO’s Complete Guide

Discover how Oriel IPO streamlines UK startup funding through SEIS & EIS schemes, attracting angel investors with clear tax incentives and a commission-free model.

2024 SEIS & EIS Investment Benefits: Expert Strategies from Oriel IPO

Unlock Oriel IPO’s expert strategies for maximising SEIS & EIS benefits in 2024, enhancing tax relief and boosting your startup investment returns.