Beyond Invoice Factoring: Equity Funding with SEIS & EIS on Oriel IPO

See how Oriel IPO offers startups a strategic path beyond invoice factoring through commission-free SEIS and EIS equity funding.

Curated Private Market Access: SEIS & EIS Investments on Oriel IPO

Compare traditional private markets with Oriel IPO’s curated SEIS and EIS marketplace for streamlined, commission-free startup investments.

Equity Crowdfunding vs Traditional Loans: Why SEIS/EIS Wins for UK Startups

Compare equity crowdfunding and business loans to discover why SEIS/EIS equity financing offers tax relief and commission-free benefits.

Venture Capital vs SEIS/EIS Crowdfunding: Choosing the Best Funding Strategy

Evaluate venture capital and SEIS/EIS crowdfunding to identify the most tax-efficient, commission-free funding strategy for your UK startup.

Private Market Transactions vs SEIS/EIS Crowdfunding: A Guide for UK Startups

Compare private-market transaction workflows to SEIS/EIS equity crowdfunding to find the most streamlined, commission-free capital-raising solution.

Tokenization vs SEIS/EIS Crowdfunding: Which Funding Model Fits Your UK Startup?

Discover why SEIS/EIS equity crowdfunding offers tax-efficient, commission-free advantages for UK startups compared to tokenization models.

Equity Crowdfunding Myths Busted: Why Oriel IPO’s SEIS & EIS Platform Excels

Separate fact from fiction in equity crowdfunding and discover why Oriel IPO’s commission-free, SEIS and EIS-focused marketplace is the top choice for UK startups and investors.

Managing SEIS & EIS Equity with Oriel IPO’s Integrated Cap Table Tools

See how Oriel IPO’s integrated cap table and equity management tools streamline SEIS and EIS compliance for UK startups on a commission-free platform.

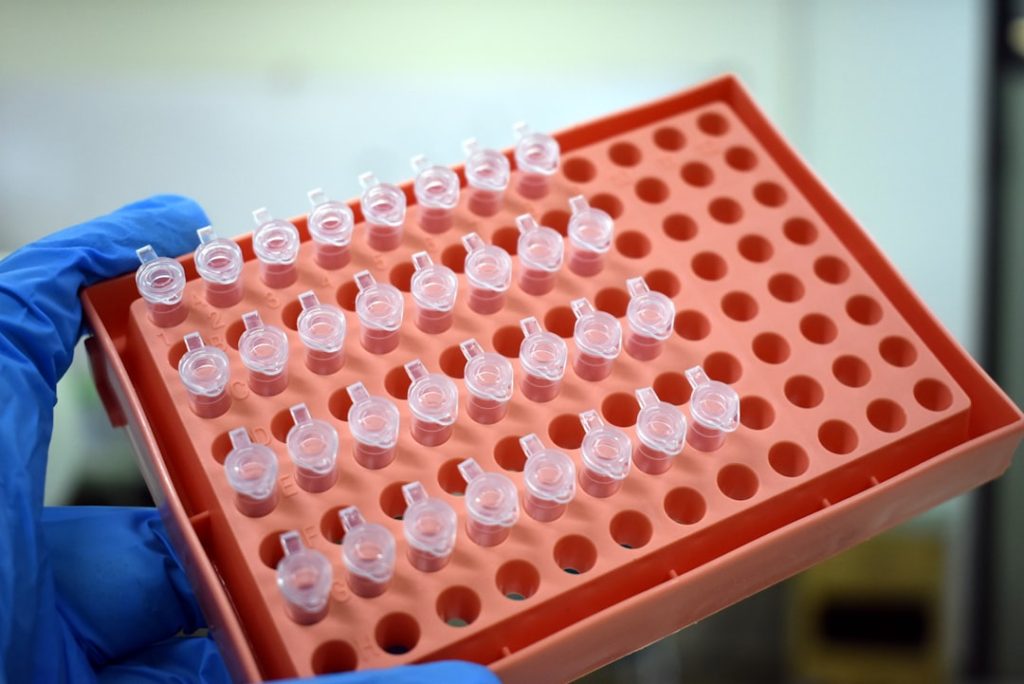

Biotech Startup Funding with SEIS & EIS: A Practical UK Founder’s Guide

Learn how UK biotech founders can navigate SEIS and EIS schemes on Oriel IPO’s commission-free platform to mitigate risks and secure growth capital.

Oriel IPO vs Traditional Platforms: Commission-Free SEIS & EIS Investing

Explore how Oriel IPO’s curated, commission-free marketplace provides UK investors with tax-efficient SEIS and EIS startup opportunities unlike traditional platforms.