Comparing Leading UK SEIS Funds: Oriel IPO vs SFC Capital

Compare SFC Capital’s SEIS offering with Oriel IPO’s commission-free platform to find the most efficient path to early-stage investment.

Securing British Pharmacological Society Engagement Grants and SEIS Investment for UK Researchers

Learn how UK pharmacology researchers can win £2K engagement grants and secure further SEIS funding for commercial spinouts via Oriel IPO.

Empowering Female-Founded Startups: Seed Funding with Oriel IPO’s SEIS Platform

Explore how Oriel IPO connects female founders with curated, tax-efficient SEIS investors to fuel women-led startup growth.

Replicating Magdrive’s $10.5M Seed Success: Space Tech Funding on Oriel IPO

Learn how aerospace startups can attract SEIS investors and follow Magdrive’s $10.5M seed funding success using Oriel IPO’s tax-efficient platform.

How AI Sign Language Startups Can Secure £2M SEIS Funding with Oriel IPO

Discover how AI sign language startups can leverage Oriel IPO’s commission-free SEIS marketplace to secure £2M seed funding and drive accessibility innovation.

The Future of Angel Investing in the UK: How Oriel IPO Transforms SEIS Engagement

Explore how Oriel IPO is reshaping UK angel investing by revitalizing SEIS opportunities through a transparent, commission-free marketplace.

Pre-Seed VC vs. Commission-Free SEIS: Choosing Oriel IPO Over Traditional UK Investors

Compare leading UK pre-seed VCs and see why Oriel IPO’s commission-free SEIS platform is the smarter choice for early-stage founders.

Boosting Research-Policy Projects: SEIS Alternative to Oxford’s OPEN Seed Fund with Oriel IPO

Discover how Oriel IPO’s SEIS platform offers a streamlined alternative to the OPEN Seed Fund for funding impactful research-policy collaborations.

Science Startups: Blending SEIS with Royal Society Research Grants for Lab Equipment

Explore how science startups can optimize SEIS funding through Oriel IPO while tapping into Royal Society research grants for essential lab equipment.

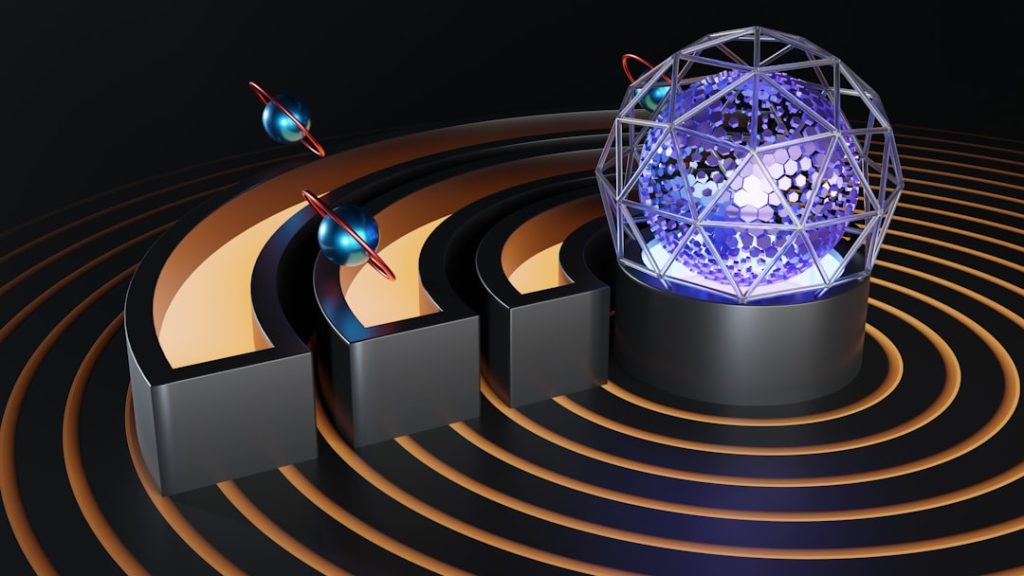

How Oriel IPO Helps Quantum Computing Startups Secure Record UK Seed Funding

Discover how Oriel IPO’s commission-free SEIS platform empowers quantum computing startups to secure record seed funding in the UK.