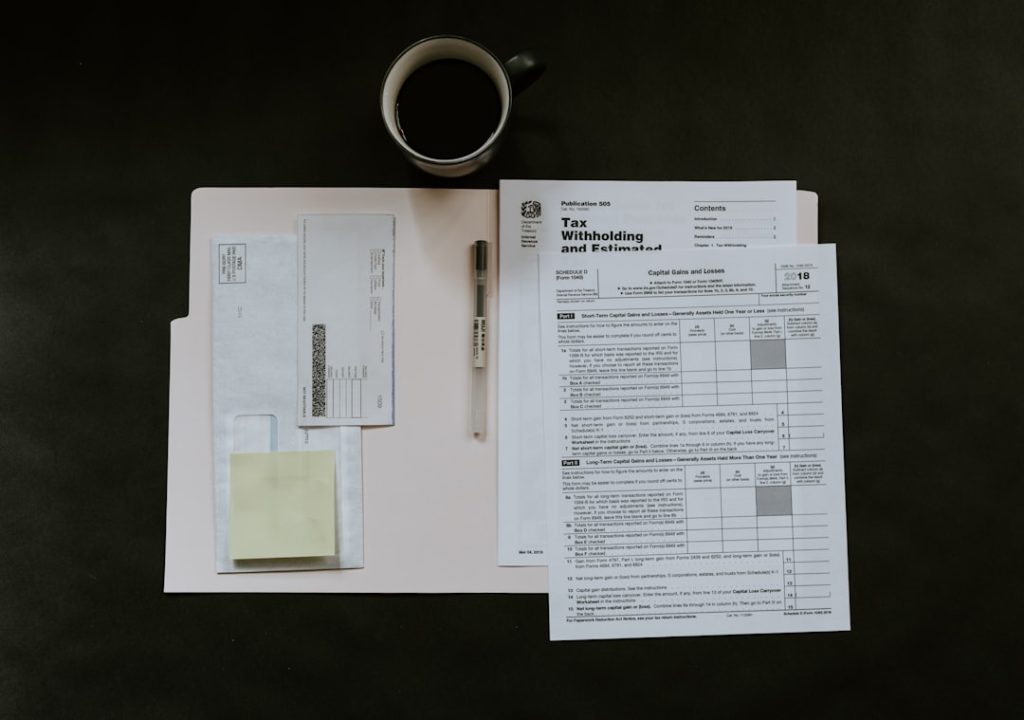

Comprehensive Guide to the Seed Enterprise Investment Scheme (SEIS)

Explore the Seed Enterprise Investment Scheme (SEIS) and how it offers tax incentives to investors backing UK startups and small businesses.

Enhancing Startup Appeal: How SEIS Attracts More Investors

Learn how leveraging SEIS can make your startup more attractive to investors and secure the funding you need for growth.

SEIS vs EIS: Key Differences and How They Benefit Your Investments

Discover the key differences between SEIS and EIS schemes and how they can maximize your investment benefits in our comprehensive guide.

SEIS vs EIS: Key Differences and How They Benefit Your Investments

Discover the key differences between SEIS and EIS schemes and how they can maximize your investment benefits in our comprehensive guide.

SEIS and EIS Schemes: Boosting Fintech Investments in the UK

Discover how SEIS and EIS schemes support and encourage investment in Fintech businesses through valuable tax incentives.

SEIS: Minimizing Risk and Maximizing Returns with Tax Reliefs

Learn how the SEIS helps minimize investment risks and maximize returns for UK startups through various tax reliefs.

SEIS Explained: Benefits, Eligibility, and Investment Risks

Understand the Seed Enterprise Investment Scheme (SEIS), including its benefits, eligibility criteria, and associated investment risks.

EIS and SEIS Investment Schemes: Your Guide to Tax Relief

Explore our easy guide to EIS and SEIS investment schemes, and learn how to benefit from tax reliefs when investing in early-stage companies.

EIS and SEIS Benefits: Insights from Angel Investor Patrick Nash

Gain expert perspectives on the benefits of EIS and SEIS through our Q&A with seasoned angel investor Patrick Nash.

Understanding SEIS: Eligibility, Benefits, and How to Apply

Explore the Seed Enterprise Investment Scheme (SEIS), its eligibility criteria, benefits, and application process to optimize your startup investments.