Tax-Efficient Investing: Maximizing Bonus Depreciation through Equipment Leasing

Learn how to leverage equipment leasing investments and bonus depreciation to enhance your tax-efficient investment strategies.

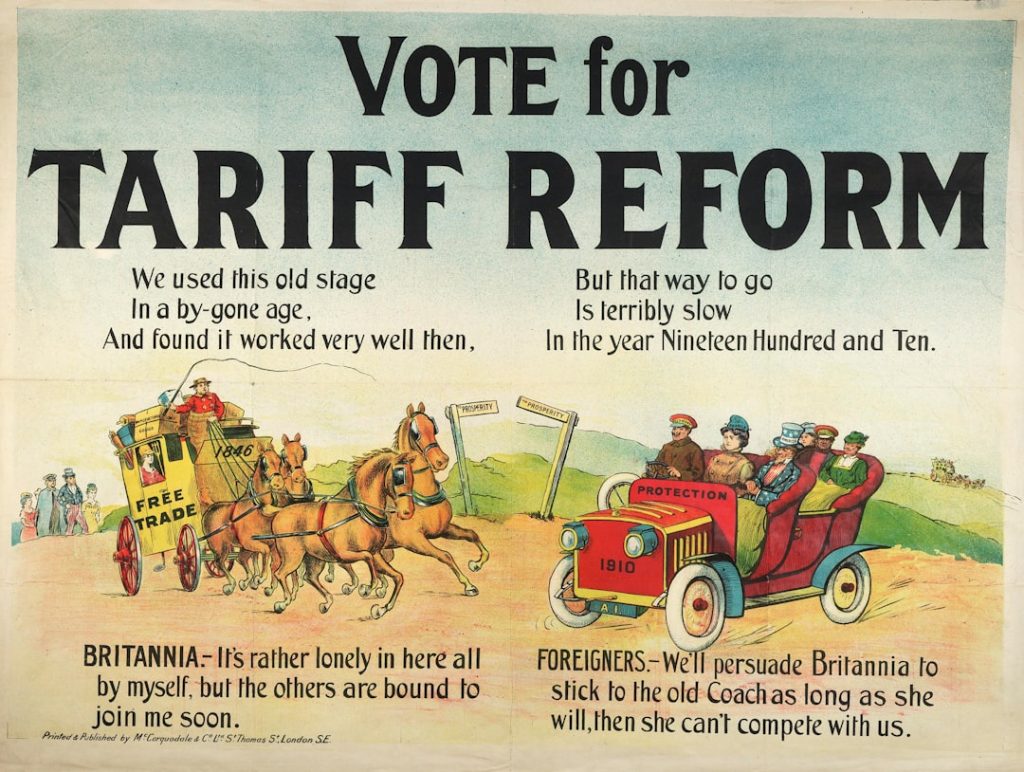

Top Tax-Efficient Investment Tools to Maximize Your Returns in the UK

Explore the best tax-efficient investment tools available in the UK to help you maximize your returns and minimize your tax liabilities.

Top Tax-Efficient Investment Tools to Maximize Your Returns

Discover the best tax-efficient investment tools and strategies to help you maximize your returns and minimize tax liabilities.

Enhancing Future Savings with Tax-Efficient Investment Tools: Beyond Junior Cash ISAs

Discover how alternative tax-efficient investment tools can maximize future savings for your children beyond Junior Cash ISAs.

Maximize Your Savings with Tax-Efficient Investment Tools: The Power of Roth IRAs

Explore how Roth IRAs serve as a powerful tax-efficient investment tool for diversified and tax-optimized retirement planning.

Mastering Tax-Efficient Investment Tools: PIMCO’s Strategies for Optimal Returns

Discover how PIMCO’s tax-efficient investment tools, including mutual funds and ETFs, can help maximize your clients’ investment returns.

The Ultimate Guide to Tax-Efficient ETF Investing: Top Tools and Strategies

Maximize your investment returns with our ultimate guide to tax-efficient ETF investing, featuring top tools and strategic account management techniques.

7 Tax-Efficient Investment Tools and Strategies to Minimize Your Taxes

Discover seven tax-efficient investment tools and strategies to legally reduce, defer, or eliminate taxes on your gains, helping you keep more of your profits.

Optimize Securities Sales: Morgan Stanley’s Tax Efficiency Tools for Reduced Withdrawal Taxes

Explore Morgan Stanley’s Intelligent Withdrawals tool and other tax-efficient investment tools to minimize withdrawal taxes and leverage tax-loss harvesting opportunities.

Master Tax-Efficient Investing: Top Investment Tools to Maximize Your Wealth

Learn how to master tax-efficient investing with leading investment tools and strategies that help you maximize returns and retain more of your wealth.