Understanding State Sales and Use Taxes in Tax-Efficient Crowdfunding

Explore how state sales and use taxes impact tax-efficient crowdfunding and learn about recent guidance from the Washington State Department of Revenue.

Essential Tax Guidelines for Gold Investors in the UK

Learn about the tax obligations and strategies for gold investment in the UK to make informed, tax-efficient investment decisions.

Comprehensive Guide to Tax on Savings and Investments in the UK

Get detailed information on taxes for savings, investments, shares, and dividends in the UK with our comprehensive GOV.UK guide.

10 Expert Tax-Saving Strategies for Tax-Efficient Investing in the UK

Learn 10 effective and legal tax-saving strategies in the UK to enhance your tax-efficient investing and maximize your savings.

Comprehensive Guide to Virginia Tax Deductions and Reductions

Learn about Virginia tax deductions and income subtraction strategies to effectively reduce your tax liability in our comprehensive tax guide.

Understanding the Tax Impact of Investment Apps with Optima Tax Relief Platform

Learn how investment apps influence your taxes and discover effective strategies with the Optima Tax Relief investment platform.

Day Trading Taxes: Utilizing Tax Relief Investment Platforms to Minimize Liability

Understand how tax relief investment platforms can help day traders manage their tax liabilities effectively through strategic planning and investment choices.

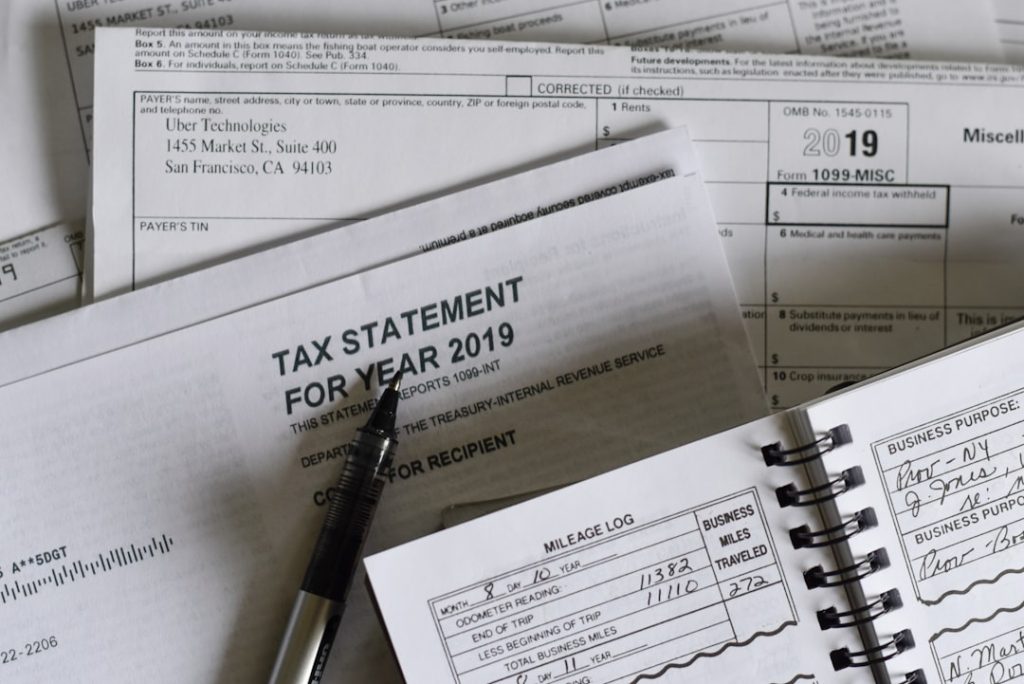

Navigating Tax Reporting for Digital Assets on Investment Platforms

Learn how to accurately report your cryptocurrency and NFT transactions on tax relief investment platforms with our comprehensive guide.

Maximize Your Returns: Tax Relief Investment Platforms and Deductible Investment Expenses

Find out which investment expenses are tax-deductible and how tax relief investment platforms can enhance your financial strategy.

9 Essential Tax Saving Strategies to Reduce Your Tax Bill

Learn nine essential tax saving strategies that can help you reduce your tax bill and optimize your financial planning.